Changes to EU VAT legislation as of 1st July 2021 mean that ecommerce stores can choose to charge VAT at point of purchase or leave consumers to pay VAT upon importation under a scheme known as IOSS. This plugin provides configuration options and functionality to support compliance and give store managers a choice of how to handle compliance.

User experience

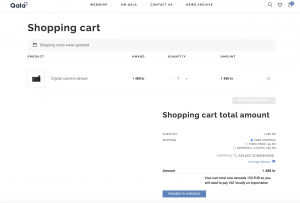

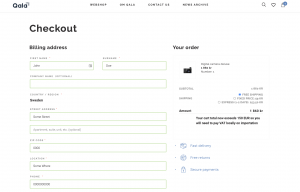

When a customer visits their cart, the page will:

- Display any relevant, configured message from the store manager advising them about VAT implications (i.e. is it included or not?)

- Display the correct pricing based on the cart total and the store’s configuration with regards to VAT

This ensures that (when appropriately configured), visitors are charged VAT according to the store’s policy and configuration settings with regards to EU VAT.

Benefits

- The plugin works with any WooCommerce store

- It uses the cart value pre-tax but including shipping costs. There is an option that lets you choose to include shipping or not.

- If the cart value is less than 150 EUR, the plugin applies VAT. This 150 EUR limit is configurable if merchants want to play it safe by using a 140 EUR limit for example.

- Supports any checkout currency by converting the cart value to EUR.

- Can display a configurable message to the user in the cart if under/over limit. E.g. ‘You are under the VAT limit, we’re not charging tax, you’ll have to pay that to your customs.’

- Includes this notice on the customer invoice and shipping slip too. Supports this plugin and this one.

- Works with tax-inclusive/exclusive product inventory (this is a WooCommerce configuration option).